» It notes that Grupo Enerpro, a privately held Spanish company, developed and connected the country´s first unsubsidizes 1 megawatt utility-scale solar proyect to the grid, and it plans to develop ten more projects in 2014.»

The difference in the cost of electricity generated using solar power and electricity generated through conventional sources such as coal or natural gas also varies across regions,”it notes.

“HSBC equity research analysts believe that without considering the favorable effects of policies and supportive

schemes, several states in the U.S. and markets in Europe have already reached retail grid parity.”

It notes that Grupo Enerpro, a privately held Spanish company, developed and connected the country’s first unsubsidized 1 megawatt utility-scale solar project to the grid, and it plans to develop ten more projects in 2014.

It also noted supportive policies in the world’s three biggest economies — the U.S., China, and Japan — and in some

key emerging markets such as Brazil, Peru and Chile.

Brazil recently conducted its first “solar auction” that allocated 123 MW of capacity at an average price of $97.80 per MWh; Peru has mandated solar for 500,000 off-grid homes by 2016; and Chile is the host of numerous largescale solar projects, including the world’s largest “merchant” solar plant — a project built to sell electricity into the open market.

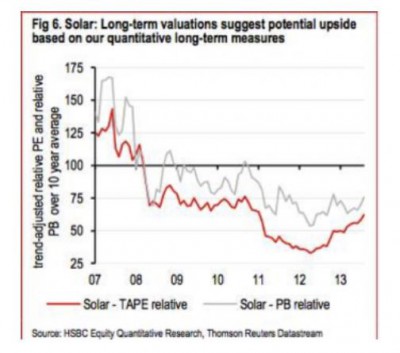

Despite allthis, HSBC says solar stocks still look attractive and offers an upside potential of 61 percent based on long- term relative price. In the graph below, the red line shows the potential upside on its trend-adjusted price earnings estimates, while the gray line shows the upside based on its price-to-book valuations. Both are key metrics in the world of financial analysts.

HSBC says another key factor is that finance for the solar market and the deployment of modules are both being facilitated by the issue of “green bonds” and the floating of numerous YieldCos, which offer attractive rates of return for investment in solar projects.

The solar market is forecast to grow 16 percent a year, and the twelve-month forward consensus earnings growth forecast for Global Solar is 87 percent. HSBC notes that while in 2013, its climate change index was dominated by the energy efficiency and energy management subsectors, it is the low-carbon energy production index that has taken the lead in 2014.

Apart from solar, the wind index has delivered a return of 16.5 percent so far in 2014, while other renewables including the categories Diversified Renewables and

Hydro/Geothermal/Marine are up 9.9 percent and 8.9 percent, respectively.