» It notes that Grupo enerpro, a privately held Spanish company, developed and conected the country´s first unsubsidized 1MW utility-scale solar proyect to the grid and it plans to develop 10 further proyects in 2004.»

HSBC says there are a bunch of reasons for solar’s strong showing: a combination of favourable policy initiatives in key markets, increased investment flows (public market investment doubled to $US6.3 billion in 2013) , and stabilisation of prices of solar panels and attractive valuations. All of which have contributed to a supportive base for investors.

The over-riding theme – though – is that of grid parity. As HSBC notes, the price of solar continues to move further towards

grid parity – at utility scale, not just at the socket – in many regions, making the technology more affordable and viable with

less support from governments. That means it can continue to grow even when subsidies are finally removed.

Despite all this, HSBC says solar stocks still look attractive – and offers an upside potential of 61 per cent based on long term relative price. In the graph to the right, the red line shows the potential upside on its trend adjusted price earnings estimates, while the grey line shows the upside based on its price-tobook valuations. Both are key metrics in the financial analysts world.

HSBC says another key factor is that finance for the solar market and the deployment of modules is being lubricated by the

issue of “green bonds” and the floating of numerous “yield companies”, which offer attractive rates of return for investment

in solar projects. The solar market is forecast to grow 16 per cent a year, and the 12-month forward consensus earnings growth forecast for Global Solar is 87 per cent; driven mainly by 247 per cent earnings growth forecast for Asia Pacific ex Japan and 153 percent for the Asia-Pacific.

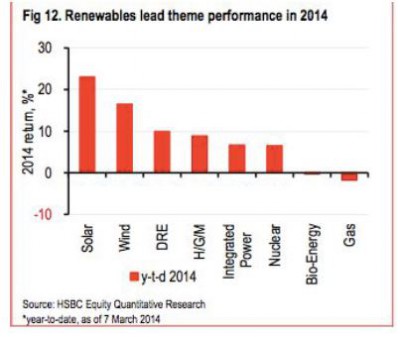

HSBC notes that while in 2013, its climate change index was dominated by the energy efficiency and energy management

sub-sectors, it is the low carbon energy production index that has taken the helm in 2014.

Apart from solar, the wind index has delivered a return of 16.5 per cent so far in 2014, while other renewables including

Diversified Renewables and Hydro/Geothermal/Marine are up 9.9 per cent and 8.9 per cent, respectively.

Finally, Australian readers might be wondering, where is the opportunity for investors in Australian stocks? Well, good luck with that. No Australian stock marked the HSBC solar index. In fact, no Australian stock makes the HSBC climate change index – despite the fact that the Asia-Pacific region is the fastest growing, and best returning geographical region of its global index. As an investment slogan it might best be described as “Missed the Boat.”